|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

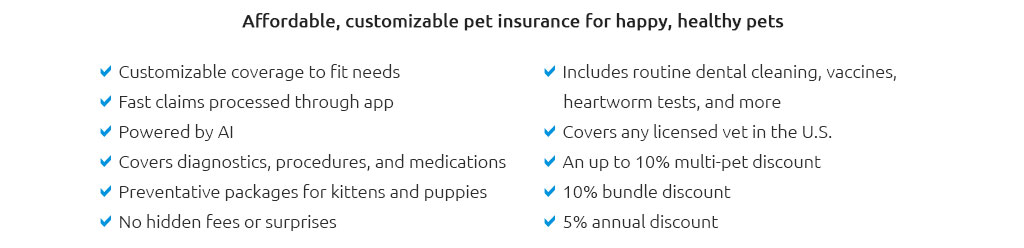

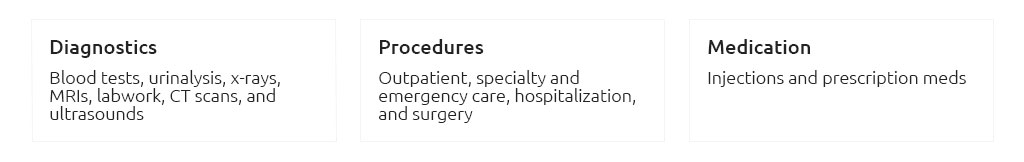

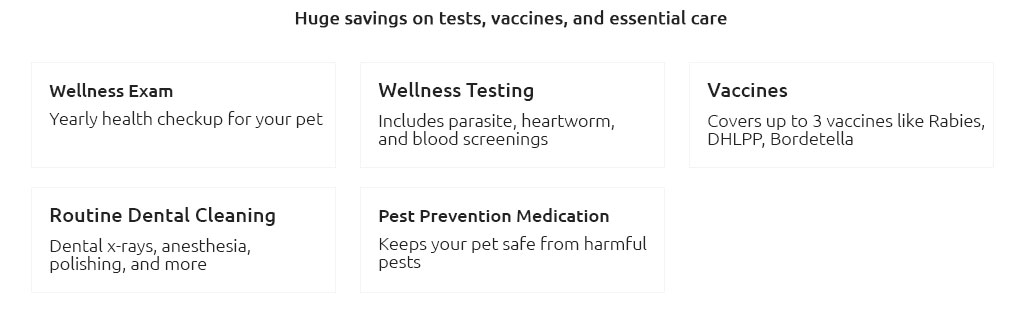

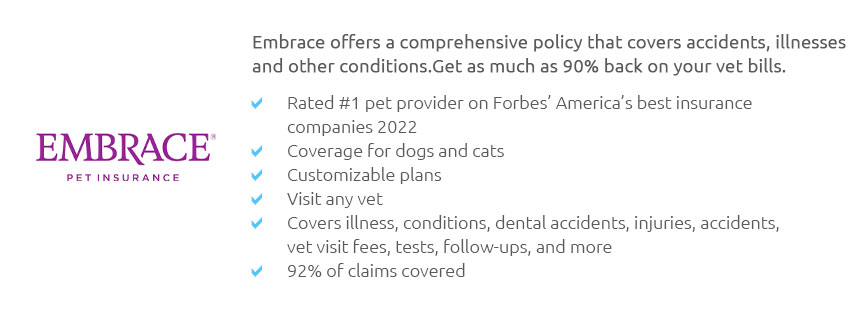

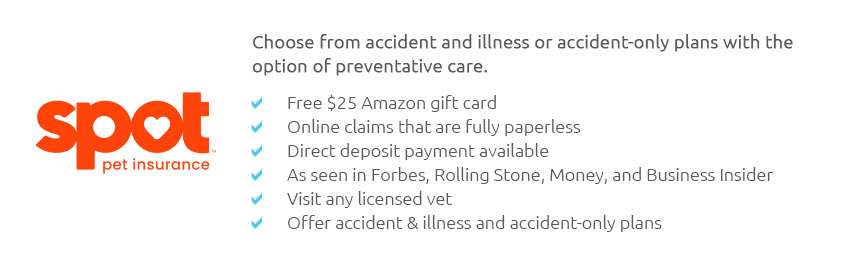

Understanding Pet Wellness Insurance: Making Informed DecisionsIn recent years, pet wellness insurance has emerged as a topic of great interest among pet owners who wish to ensure the comprehensive health care of their beloved animals; however, the concept often leads to questions and concerns, which we aim to address in this discussion. Pet wellness insurance differs from traditional pet insurance primarily in its focus on preventive care rather than covering unexpected illnesses or injuries, a distinction that holds significant importance for those looking to maintain their pet's long-term well-being. Generally, pet wellness plans encompass a variety of services and treatments that include routine check-ups, vaccinations, dental cleanings, and even dietary consultations, which, when combined, contribute to the overall health and happiness of our furry companions. One might ask: Why opt for wellness insurance instead of setting aside money for potential future vet visits? The answer lies in the predictability and accessibility that wellness plans provide, as they allow pet owners to anticipate and manage regular care expenses more efficiently. Moreover, these plans often come with added benefits, such as discounts on specific services or products, which can prove economically beneficial over time. However, it is crucial for pet owners to thoroughly evaluate different plans and providers, as the scope of coverage, premiums, and benefits can vary significantly, necessitating a meticulous approach to ensure the chosen plan aligns with the specific needs of their pet.

In conclusion, while pet wellness insurance may not be a one-size-fits-all solution, it undeniably offers a proactive approach to pet care that emphasizes the importance of preventive health measures, allowing pet owners to make informed decisions that prioritize the longevity and quality of life of their cherished animals. Ultimately, by weighing the benefits against potential drawbacks, one can determine whether such a plan is a prudent investment for their pet's future, ensuring a healthier, happier companion for years to come. https://www.bankrate.com/insurance/pet-insurance/best-pet-wellness-plans/

Pet wellness plans are available as supplementary options to pet insurance or as individual plans. Certain veterinary clinics offer wellness programs to assist ... https://www.petinsurance.com/whats-covered/

For more details, visit Nationwide's accident only pet insurance page. https://www.petco.com/content/content-hub/home/articlePages/health-wellness/pet-insurance-for-routine-care.html

Pet wellness plans can be purchased on their own or added to an existing insurance policy. These plans provide coverage for routine care including regular exams ...

|